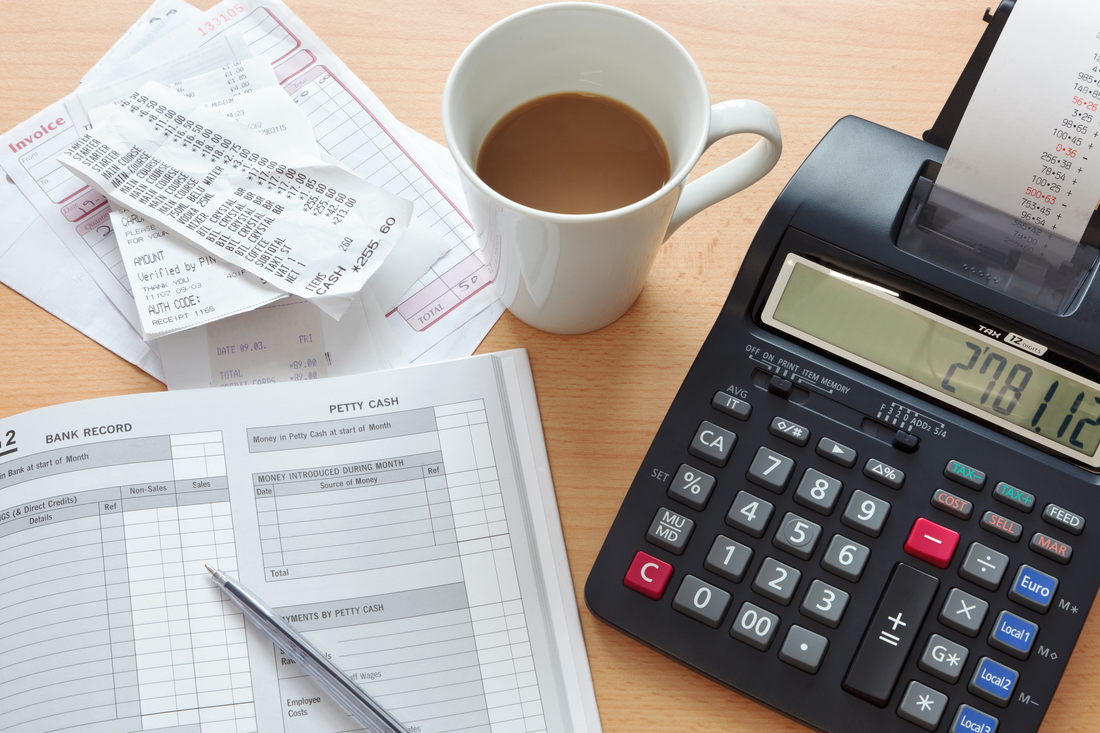

1. Set a budget

Before you even begin to look at accounting software options, you need to set a budget. Available software ranges in price from less than $100 to more than $1000. You’ll need to decide what your business can afford. If you own a small business, for example, you may be fine with a less expensive option, but if you have a large business with a large amount of accounting needs, you’ll want to budget more. Do not simply go with the least expensive option, but do know your limits.

RSS Feed

RSS Feed