Here are 4 tips to keep your startup running smoothly during times of growth:

|

Your business is starting to grow. There are exciting opportunities for your company to soar into the stratosphere. At the same time, there are new problems that you didn't need to address when you were in the infancy stage of your business. How do you deal with these new problems and keep your business moving up and to the right.

Here are 4 tips to keep your startup running smoothly during times of growth:

1 Comment

Managing payroll is a time-consuming task and if not done correctly, it can result in a loss of precious time and money. For instance, late or inaccurate payroll could cause delayed paychecks and late penalties from the IRS. But, do not despair, we've compiled a list of 10 tips to make payroll management simpler.

Here are our 10 tips to streamline payroll management: 1. Select a good payroll system Identify a cloud-based, payroll system that records and documents data, tracks health care insurance contributions, 401K plans and wage garnishments.

You've done it! You've set out on your own and now you get to make all the decisions. Maybe you’re learning that decision making is tough, and you’re feeling overwhelmed. You may need to bring in some help, and we think a bookkeeper can be one of your most valuable assets as a business.

Here are 5 reasons you should seriously consider adding a bookkeeper to your business:

Peace of Mind. Financial and tax issues can kill your business before you get the opportunity to reap the benefits of all your hard work. Hiring a bookkeeper can give you the peace of mind that your finances are handled correctly and ready for tax time. You can focus on your area of expertise, while they focus on theirs.

For a lot of people, accounting looks like a big ball of confusion. A maze of spreadsheets and receipts can overwhelm even the most number savvy business owner. We hope that explaining some of the key terms of accounting will help to calm your fears.

Here are some definitions of accounting terms for non-accountants: Debits and Credits - A debit is money coming out of an account and a credit is money coming in. When you subtract debits from credits you get the balance of your account. If you have more debits than credits, well, you’re in the red.

The Profit and Loss Statement (aka Income Statement) - A summary of all operating transactions that occurred within a specific period of time – usually a calendar month. In other words: sales minus expenses. This report lets you know if your business is profitable during that period of time.

A lot of people who aren't "numbers people" group people who work with numbers and data into the same category. This post will explain the differences between an accountant and a bookkeeper so you can understand why your CPA should never be your bookkeeper (and vice-versa).

The best way to explain is to tell you what a bookkeeper does and what a CPA does:

What a bookkeeper does

Let's start with the background of a bookkeeper. Many bookkeepers get started as data entry clerks, which is an entry-level position that doesn't require a college degree (in most companies). With experience, they can move into the role of bookkeeper, and eventually, if they want, they can obtain certification and/or higher education to move into an accounting role.

While you understand how to put ideas into action, this doesn't always mean being proficient at the bookkeeping and payroll needs. For the wise small business owner, delegating the bookkeeping and payroll should be the norm. This way, you can enjoy the small business culture without the headaches of crunching numbers.

The Joys of Business Ownership

You know why you started your business, maybe it was to gain freedom from the chains of corporate America, or maybe it was simply to wake up every morning and do what you love! There are so many benefits to being a business owner. Regardless of your reasons you have grabbed your life by the reigns and are building a life you want to live.

Business plans help put an idea or product into motion. Even if you are a small business, you can benefit from a detailed business plan for achieving goals. A business plan states the exact mission of your business, and the steps that need to be taken to be successful.

The Importance of having a Business Plan

This plan will help a business state clearly its future goals, and which way to go to achieve them. Without this business plan it is very easy to get lost. The plan keeps the company on track to being successful. Small business and entrepreneurs will better understand their market when using a business plan.

Your business is a series of credits and debits. It’s important to keep track of your expenses and income to make your taxes easier at the end of the year. An ERP (Enterprise Resource Planning) accounting software is a useful tool that can manage and automate many back-end office functions. Depending on the software you choose, some can integrate different departments, including sales and marketing, manufacturing, product planning and development.

When you have all of this data in one application, you can see improved decision-making and a more complete grasp of cash flow. Below are some of the benefits your business may experience if you decide to use an ERP accounting software:

So you’re following your dreams and are well on your way to business success. You get to work with your hands, work with people or maybe even work alone and you couldn’t be happier! But somedays the practicallity of running your own business nag at you endlessly, keeping you awake at night. We are here to tell you that one of those nags, payroll, is nothing to be feared, in fact we think it’s something to love!

Here are 3 reasons why we love payroll, and think you should too:

Plan Your Cash Flow

Cash is the lifeblood of your business so it is very important that your company has a system in place. The right system will keep track of when and how your employees and payroll taxes should be paid. A regular schedule allows you to budget your cash flow ahead of time and avoid potential problems. Running payroll well will prevent you from surprises down the road.

Money never sleeps and neither do most entrepreneurs and start-up founders - especially if you love what you do! Since we know how stressful it is running a business and we specialize in finding ways to simplify your life by handling your payroll, we wanted to share some helpful tips that will encourage you to relax and unwind.

Culture has become a major part of branding, and as part of the culture of many small businesses and startups, more people are working from home than we’ve ever seen before. While this is great for employee morale, it can be a stressor on your team as a whole.

Here are our tips for working with remote employees:

One of the things that many small businesses don't account for, especially during the start-up phase of operations, is the need for small business office support. It's one thing to have a great idea and the drive and motivation to get that idea off the ground. It's quite another to take your fantastic idea and keep it running once it's been established, and that's where small business office support comes in.

For a lot of small business owners, accounting can be tedious and time consuming. Unfortunately it’s non-optional as a business owner. It’s best to stay organized and up-to-date with everything to lower the burden.

Here are our 10 Tips for Small Business Accounting:

Keep it simple:

Don’t over complicate the matter. Keep your spreadsheets or software and organizational systems in line and easy to follow.

Every company wants to hire the best talent possible for what they are willing to pay. And when it comes to employee compensation, it must not only attract talent but also retain talent. Attracting and hiring top talent is ineffective unless you can are able to keep them around.

For this reason, whether your HR is in-house or outsourced, an effective benefits package is essential to retention. In addition, preparing customized benefits packages demonstrates the value the company places on the individual employee.

Outsourcing services - we all have an opinion on it. Whether you have extensive knowledge on the subject or are beginning to research this important business strategy, the resulting decision is crucial to your year-end balance sheet.

As a business owner, it is hard to release control of any part of your business to someone else. Before you make a snap judgement, consider the advantages of giving the responsibility to someone else to increase your profits. Here’s why outsourcing will increase your profits:

Building a business means executing your business plan and reviewing all options for cost savings. Outsourcing will increase your profits by reducing your responsibility, stress and business expenses. To talk more about this, or if you have any questions, contact us! We’d love to help.

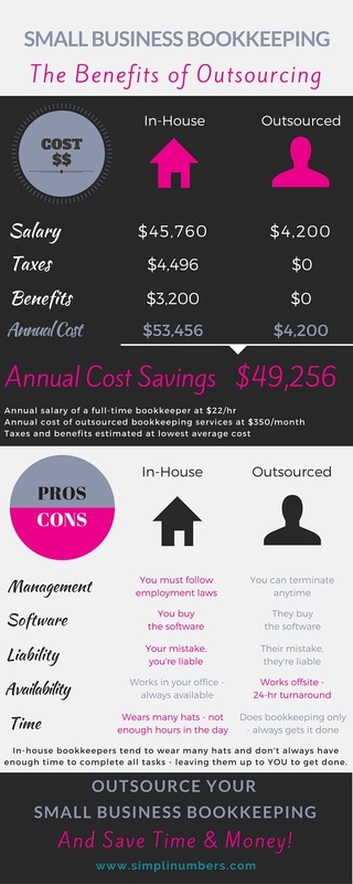

Our quick infographic shows you the benefits of outsourcing your bookkeeping vs hiring an in-house bookkeeper. Click here for a larger, printable version.

Filing and paying taxes is a part of doing business, but as a small business owner writing the check is often the least painful part of the process. Filing tax forms is a real hassle if you leave it until the deadline is staring you in the face.

If you don't have a back-office staff, you'll be the one gathering all the information you need to satisfy the IRS, consuming time and resources you don't have. But it doesn't have to be that way. Preparing for tax season isn't a one-time event, it's a continuous process. If you start now, you can avoid the last-minute scramble. Outsourcing your bookkeeping needs is a good first step to getting a handle on your taxes. But if you want to do it yourself, here are some other tips:

The cloud has quickly evolved from an IT tool to a mainstream concept that is now a regular part of business conversation. Companies of all sizes are beginning to explore the benefits of moving their operation to a cloud-based system. So what potential does it hold for your business?

Moving to the cloud means that technology functions such as large applications, data, software and more can be housed remotely and accessed through an Internet connection. The top five benefits of using cloud-based services are worth considering, regardless of your company’s size: cost-savings, mobile access, scalability, disaster protection, and security. |

RSS Feed

RSS Feed